How to Calculate TAM SAM SOM Using AI Tools: A Strategic Guide

Did you know that 90% of startups fail, often due to misreading market potential? In a world where precision can make or break your business strategy, traditional market sizing methods are no longer enough.

Product managers and strategists face a critical challenge: how to accurately gauge market opportunity without drowning in complex calculations or relying on gut instinct. Manually estimating Total Addressable Market (TAM), Serviceable Addressable Market (SAM), and Serviceable Obtainable Market (SOM) has been time-consuming, error-prone, and frustratingly imprecise.

What if you could leverage AI-powered tools to transform market analysis from a guessing game into a data-driven, strategic advantage? This guide reveals breakthrough techniques that enable scaling startups and enterprises to quantify market potential with unprecedented accuracy, helping you make smarter investment decisions and dramatically improve your go-to-market strategy.

Understanding the Basics: TAM, SAM, and SOM Market Analysis

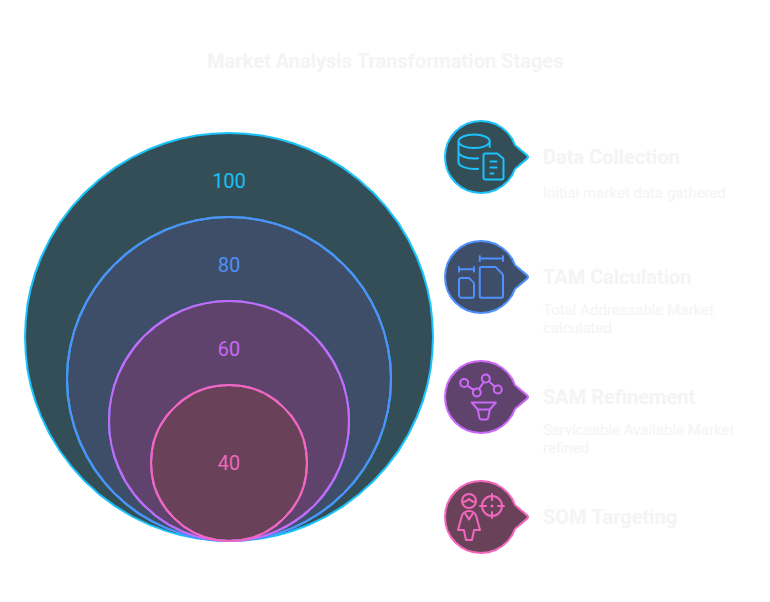

Market sizing isn't just about numbers—it's about strategic clarity. Total Addressable Market (TAM), Serviceable Addressable Market (SAM), and Serviceable Obtainable Market (SOM) represent hierarchical market segmentation that helps businesses map their true growth potential.

- TAM: The complete revenue opportunity for a product or service across all potential markets and customers

- SAM: The segment of TAM targeted by your specific product or solution, considering geographical, technological, or industry constraints

- SOM: The realistic market share you can capture in the near term, accounting for competitive landscape and your company's capabilities

By breaking down market potential into these strategic layers, businesses gain a nuanced understanding of their growth trajectory. These metrics aren't just academic exercises—they're critical decision-making tools that inform product development, marketing strategies, and investment priorities. For scaling startups and enterprises, precise market sizing means the difference between reactive guesswork and proactive, data-driven expansion.

Why Market Sizing Matters: Strategic Insights for B2B Growth

For B2B companies and SMBs navigating complex market landscapes, understanding your true market potential isn't a luxury—it's a strategic imperative. AI-powered market sizing transforms ambiguous growth strategies into precision-driven roadmaps.

Key Business Benefits

-

Optimized Resource Allocation

By pinpointing exactly where market opportunities exist, businesses can strategically deploy capital, talent, and marketing resources with laser-focused efficiency.

-

Enhanced Product-Market Fit

Detailed market segmentation helps teams develop solutions that directly address specific customer needs, reducing product development waste and increasing adoption rates.

-

Investor Confidence

Investors crave data-driven insights. Robust market sizing analysis demonstrates strategic thinking and reduces perceived investment risk.

-

Competitive Positioning

Understanding your serviceable obtainable market enables more precise competitive differentiation and targeted go-to-market strategies.

Critical Pitfalls to Avoid

Most businesses stumble by:

- Relying on outdated or manually collected market data

- Overestimating market potential without rigorous segmentation

- Neglecting competitive dynamics in market sizing calculations

- Failing to regularly update market analysis as industry landscapes evolve

By embracing AI-powered market sizing tools, businesses transform market analysis from a static snapshot into a dynamic, actionable strategic asset.

AI-Powered Market Sizing: A Step-by-Step Process for TAM SAM SOM Calculation

Transforming market analysis from a complex challenge to a strategic advantage requires a systematic approach powered by AI technologies.

Step 1: Data Collection and Preparation

-

Gather Initial Market Data

Leverage AI-powered market research platforms like Crunchbase, CB Insights, or industry-specific databases to collect comprehensive market intelligence.

-

Pro Tip: Use multiple data sources to cross-validate information and reduce potential bias

-

Potential Pitfall: Avoid relying solely on one data source; diversity ensures more accurate insights

Step 2: TAM Calculation Methodology

-

Top-Down Approach

Utilize AI tools to analyze total market size, industry reports, and macroeconomic indicators. Machine learning algorithms can quickly aggregate and interpret complex datasets.

-

Bottom-Up Validation

Cross-reference top-down estimates with granular customer segment analysis, using AI to identify precise revenue potential per customer category.

-

Pro Tip: AI-driven predictive models can help extrapolate market trends and future growth potential

-

Mistake to Avoid: Don't assume static market conditions; continuously update your models

Step 3: Refining SAM Calculations

-

Segment Identification

Use machine learning algorithms to narrow TAM into serviceable markets based on: • Geographic constraints • Technological compatibility • Industry-specific requirements

-

Competitive Landscape Analysis

AI tools can map competitive positioning, helping you understand realistic market penetration opportunities.

-

Pro Tip: Leverage natural language processing to analyze competitor positioning and market gaps

-

Potential Pitfall: Avoid over-segmentation that might limit your market perspective

Step 4: SOM Precision Targeting

-

Realistic Market Share Estimation

Apply AI-driven predictive modeling to estimate achievable market share considering: • Your current capabilities • Resource constraints • Competitive differentiation

-

Dynamic Adjustment Mechanisms

Implement machine learning models that can adapt market estimates based on real-time performance data.

-

Pro Tip: Create scenario-based models to understand potential variations in market capture

-

Mistake to Avoid: Don't become overly conservative or unrealistically optimistic

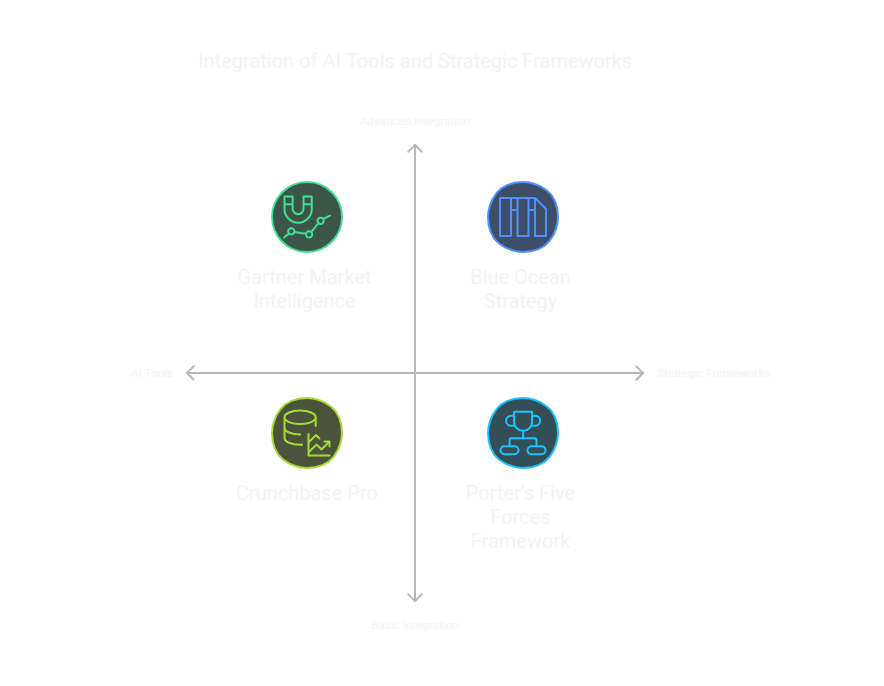

Essential Tools and Frameworks for AI-Powered Market Sizing

Recommended AI-Powered Market Analysis Tools

-

CB Insights

An AI-driven platform offering comprehensive market intelligence, startup tracking, and predictive analytics. Ideal for identifying market trends, competitive landscapes, and potential growth opportunities.

-

Crunchbase Pro

Leverages machine learning to provide real-time data on companies, investors, and market segments. Enables precise TAM and SAM calculations through detailed company and industry insights.

-

PitchBook

Advanced data platform using AI to analyze venture capital, private equity, and M&A markets. Provides nuanced market sizing data for B2B strategists seeking deep market understanding.

-

Gartner Market Intelligence

Combines AI-powered research with expert analysis to deliver comprehensive market sizing and trend forecasting across multiple industries.

Strategic Frameworks for Market Opportunity Analysis

-

Porter's Five Forces Framework

Complements AI-driven market sizing by providing a structured approach to understanding competitive dynamics. Helps contextualize SOM calculations by analyzing: • Competitive rivalry • Supplier power • Customer power • Threat of new entrants • Threat of substitution

-

Blue Ocean Strategy

Integrates seamlessly with AI market analysis by identifying uncontested market spaces. Helps businesses move beyond traditional market sizing to discover innovative growth opportunities.

-

Lean Startup Methodology

Provides a validation mechanism for AI-generated market insights. Enables rapid testing and iteration of market assumptions through: • Minimum viable product development • Continuous customer feedback • Data-driven market refinement

By combining AI-powered tools with established strategic frameworks, businesses can transform market sizing from a static exercise into a dynamic, insights-driven process.

Conclusion: Leveraging AI for Precision Market Sizing

As B2B strategists and product managers navigate increasingly complex market landscapes, AI-powered tools have become transformative in calculating TAM, SAM, and SOM with unprecedented accuracy and efficiency. By integrating advanced machine learning algorithms, predictive analytics, and comprehensive data aggregation techniques, professionals can now move beyond traditional estimation methods to generate more granular, real-time market potential insights. The future of market opportunity analysis lies not just in collecting data, but in intelligently interpreting complex market signals through AI-driven methodologies that enable more strategic, data-driven investment decisions. Embracing these technological innovations allows organizations to develop more responsive, adaptive go-to-market strategies that can quickly pivot based on emerging market dynamics and competitive intelligence.